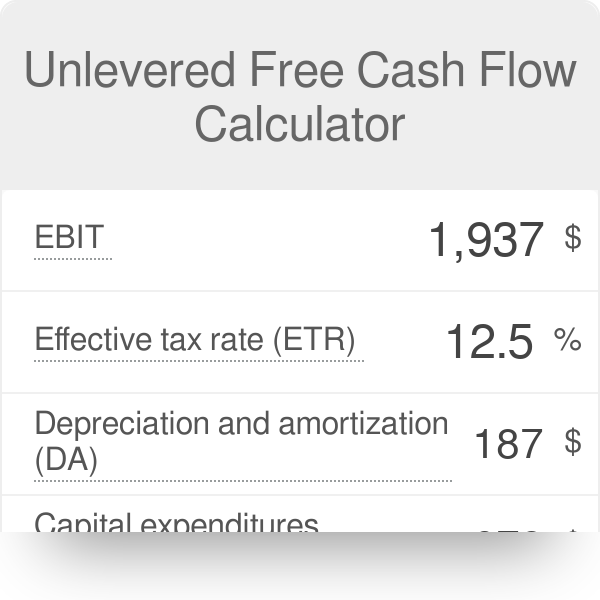

unlevered free cash flow calculator

Here is a step-by-step example of how to calculate unlevered free cash flow free cash flow to the firm. EBITDA This stands for earnings before interest taxes depreciation and amortization.

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Present value PV is the current value of a future sum of money or stream of cash flows given a specified rate of return.

. CFO Net Income non-cash expenses increase in non-cash net working capital. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Unlevered free cash flow is a financial metric used to calculate the cash generated by a business before taking interest and taxes into account.

The formula to calculate the unlevered free cash flow for a company is the following. See the formula below. FCFF Formula FCFF CFO Interest Expense 1 Tax Rate CapEx On the cash flow statement the CFO section has the bottom line from the income statement at the top which is then adjusted for non-cash expenses and changes in working capital.

To arrive at unlevered cash. In essence its a way to determine the. Because it doesnt account for all money owed UFCF is an.

Thatll bring us to Unlevered Free Cash Flow Additional Tip And there you have it. You can calculate a companys unlevered free cash flow by using the following formula. The difference between UFCF and LFCF is the financial obligations.

Putting Together the Full Projections Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx And we know that NOPAT EBIT 1 Tax Rate. Using Unlevered Free Cash Flow the formula is Net Income Interest Interest tax rate DA NWC CAPEX. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash Working Capital.

Net Income to Free Cash Flow. A business or asset that generates more cash than it invests provides a positive FCF that may be used to pay interest or retire debt service debt holders or to pay dividends or buy. This figure is also referred to as operating cash Then subtract capital expenditure which is money required to sustain business operations from its value.

Unlevered Free Cash Flow. Step 1 Cash From Operations and Net Income Cash From Operations is net income plus any non-cash expenses adjusted for changes in non-cash working capital accounts receivable inventory accounts payable etc. The look thru rule gave qualifying US.

Users can arrive at LFCF from EBITDA net income or UFCF. In other words its a measure of how much cash is generated by a companys core operations ie. Essentially this number represents a companys financial status if they were to have no debts.

How to Calculate Unlevered Free Cash Flow. When debt principle payments and interest are included in the calculation FCF is said to be levered. Using Levered Free Cash Flow the formula is Net Income DA NWC CAPEX Debt.

Levered and Unlevered Calculating free cash flow from net income depends on the type of FCF. This represents the companys earnings from core business after taxes ignoring capital structure. How do you calculate unlevered free cash flow from net income.

FCF Cash from Operations Capital Expenditure. To calculate FCF get the value of operational cash flows from your companys financial statement. To calculate Unlevered Free Cash Flow we start EBITDA less DA because its tax-deductible to get EBIT.

Future cash flows are discounted at the discount rate and the higher the discount rate. And then we tax-effect EBIT to arrive at NOPAT. It is also preferred over the levered cash flow when conducting analyses to test the impact of different capital structures on the company.

The levered free cash flow formula is as follows. The next formula for calculating FCFF starts off with cash flow from operations CFO. Unlevered FCF Yield Formula Unlevered FCF Yield Free Cash Flow to Firm Enterprise Value By standardizing in this way the yields can be benchmarked against comparable companies of different magnitudes of FCF as well as to the companys historical performance.

Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working capital - taxes What does unlevered mean. Formula and Calculation of Levered Free Cash Flow LFCF There is more than one way of calculating LFCF. UFCF EBITDA - CAPEX - Working Capital - Taxes To fully understand and successfully execute the unlevered free cash flow formula its crucial that you have a.

LFCF EBITDA Mandatory Debt Payments Change in Net Working Capital Capital Expenditures. Multiply by 1 Tax Rate to get the companys Net Operating Profit After Taxes or. Unlevered Free Cash Flow Formula Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this.

Free cash flow is one of many financial metrics that investors use. Its business activities that do not include investments in other companies debt repayments and so on. To arrive at unlevered cash flow add back interest payments or cash flows from financing.

From here we add back DA adjust for Changes in Working Capital and subtract Capital Expenditures. Begin with EBIT Earnings Before Interest and Tax Calculate the theoretical taxes the company would have to pay if they didnt have a tax shield ie without deducting interest expense Subtract the new tax figure from EBIT. Rated the 1 Accounting Solution.

Internal Revenue Code that lowered taxes for many US. Start with Operating Income EBIT on the companys Income Statement. When interest expenses and principle are excluded FCF is said to be unlevered.

Thus the formula for Cash From Operations CFO is. The unlevered cash flow is usually used as the industry norm because it allows for easier comparison of different companies cash flows. Unlevered free cash flow is the cash flow a business has excluding interest payments.

The nuance is that when FCF includes interest expense but excludes principle payments its called simple free cash flow. The formula to calculate unlevered free cash flow UFCF is as follows. Ad QuickBooks Financial Software.

On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. Before we dive in its helpful to understand what were talking about when we say unlevered. A complex provision defined in section 954c6 of the US.

What is present value of free cash flow. UFCF EBIDTA CAPEX Working Capital UCFC Unlevered Free Cash Flow EBITDA Earnings Before Interest Taxes Depreciation And Amortization CAPEX Capital Expenditures. Unlevered free cash flow is also referred to as UFCF free cash flow to the firm and FFCF.

Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. Heres what these terms mean in a little more detail. EBIT Operating income income statement t tax rate computed by dividing income taxes by EBIT.

Free Cash Flow Formula Calculator Excel Template

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Ufcf Guide Formula Examples

What S The Formula For Calculating Free Cash Flow Quora Otosection

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Calculator

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

How To Calculate Free Cash Flow Excel Examples

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition